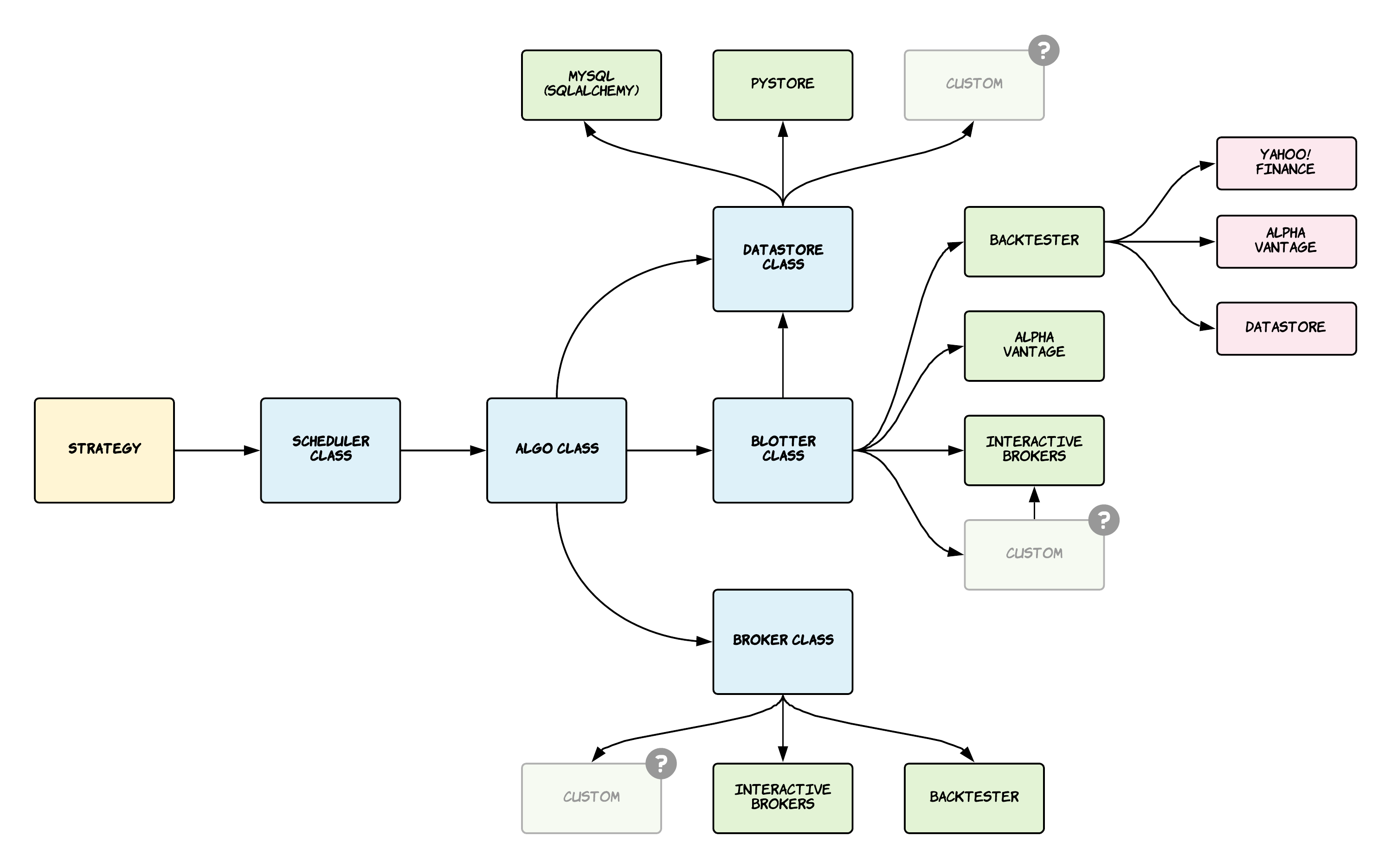

QTPyLib 2.0 Library Structure

Thinking out loud... LMK what you think :)

Example strategy

from qtpylib.algo import Algo

class TestStrategy(Algo):

def on_bar(self, bars):

bars.assign('longma', bars["close"].rolling(50).mean())

bars.assign('shortma', bars["close"].rolling(10).mean())

signals = bars['shortma'] > bars['longma']

qty = self.broker.allocate(signals, self.prices)

self.broker.buy(qty, self.prices)

Instantiation

Instantiate strategy and backtest it with 2 stocks (pseudo-code):

from qtpylib.pipline import Ticker

strategy = TestStrategy(

config="algo.toml",

instruments = [

# Ticker(<name>, <broker identifier>, <blotter identifier>), ie:

Ticker("aapl", "AAPL.STK", "AAPL@NASDAQ"),

Ticker("tsla", "TSLA.STK", "TSLA@NASDAQ"),

...

]

strategy.backtest(start="2018-01-01", end=None, data="csv://path/to/csv_directory")

from qtpylib.pipeline import Universe

strategy = TestStrategy(

config="algo.toml",

instruments = Universe.SP500

]

strategy.run()

or, using a custom universe:

1. Create universe class

# custom_universe.py

from qtpylib.pipline import Universe

class FavoriteTechStocks_IB_IQFeed(Universe):

members = [

Ticker("aapl", "AAPL.STK", "NFLX@NASDAQ")

Ticker("goog", "GOOG.STK", "NFLX@NASDAQ")

Ticker("amzn", "AMZN.STK", "NFLX@NASDAQ")

Ticker("nflx", "NFLX.STK", "NFLX@NASDAQ")

]

2. Use it in your algo

from custom_universe import FavoriteTechStocks_IB_IQFeed

strategy = TestStrategy(

config="algo.toml",

instruments = FavoriteTechStocks_IB_IQFeed

]

strategy.run()

Example of algo configuration:

# algo.toml

title = "Algo Configuration"

timezone = "US/Central"

[services]

datastore = "mysql://user:password@localhost:3306/qtpylib"

blotter = "tcp://192.168.1.29:55555:55556"

broker = "ibgw://127.0.0.1:4001/UXXXXXXX"

[sms]

provider = "nexmo"

phones = []

[backtest]

output = "~/backtests/"

data = "yahoo"

cash = 1e6

[backtest.commission]

value = 0.001

type = "percent"

[backtest.slippage]

value = 2

type = "bps"

[events]

tick = 0

bars = "10T"

book = false

[history]

tick = 10

bars = 100

preload = true

futures = "continuous"

[schedule]

date_rules = "daily"

date_offset = 0

time_rules = "market" # premarket, postmarket

time_offset = 0

calendar = "NASDAQ"

half_days = true

Hi @ranaroussi ! Will paper trading be available? Cheers and thanks Andrew

Of course!

Cheers @ranaroussi !!! Looking forward to it!!

Amazing @ranaroussi !! Do you possibly know when the 2.0 version will be released :). Rough estimates. Best, Andrew

Your plans are great, hope you are working on this :)

Why don't you borrow some concepts from BackTrader. There is a lot to like about BT, but your distributed architecture is nice. A blend of some of BT's concepts with QTPyLib 2.0 would make an awesome framework. BT's concept of Commissions, Analysers, Observers could be useful.

Looks good. The abstraction of components will help extensibility of the library. For example, right now very deep coupling with IB which I don't plan on using. Backtesting also seems very useful. Hope these changes get incorporated soon. Thanks @ranaroussi for suggesting.