portfolio

portfolio copied to clipboard

portfolio copied to clipboard

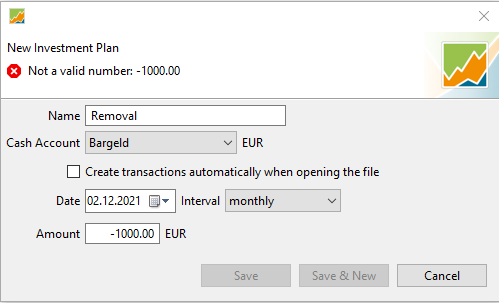

Allow investment plans for "Removals" and/or "Transfers"

Is your feature request related to a problem? Please describe. Thank you very much for this tool. I love it!

I already use the "deposit" version of investment plans to track how a loan is payed back every month. E.g. start with -10.000 € initially in the "loan" account for plus a investment plan "deposit" that adds 100 € per month to track how the loan is payed back. I would also like to automate monthly removals or transfers between deposit accounts. I tried to enter a negative value when creating a deposit investment plan, but PP rejects it, saying "-100 is not a valid number".

Describe the solution you'd like Allow to create "removals" and "transfer" investment plans, which generate the corresponding transactions.

Describe alternatives you've considered At least allow to enter negative numbers when creating a "deposit" investment plan. I can then simulate tranfers by creating two deposit plans: One for removing from one account and the other for depositing it into the other account.

Additional context

Related: #2505

For me the feature "scheduled removal/transfer of money" sounds understandable. Especially "removal" is quite easy to realize and if there is interest I would like to offer a pull request.

This would be easily implemented but leave people asking about interest, principle, and fees which usually end up being estimates that change over the life of a loan.

If the solution involves a setting to turn off field validation another real-world example is imputation credits ie negative taxes which are different to tax refunds.

For me this feature is not only about loans but about all different scenarios where money is transferred or withdrawn on a regular basis. I don't want to implement a special loan feature. And I don't think about turning off field validation. My plan is to implement a new removal operation which works similar to the existing deposit operation.

My biggest issue is that this feature will not fit with the headline "investment plans". It's more about automatically executed transactions.

Fair comment, here's some more.

This issue only arises because regular transactions were conceived as deposits and validated that way. It's a single form, optionally with securities. A positive or negative amount is a deposit or withdrawal respectively.

Is the New Plan menu really the best way to customise the form? What about investment plan fees? Maybe rename Investment Plans to Automatic Transactions and make the form smarter so New Plan is not required.

It is going to be used for loans so why not allow categories (for principle/interest or whatever even if it's not automatically calculated)? It would complicate the form so securities and categories could be hidden unless enabled.