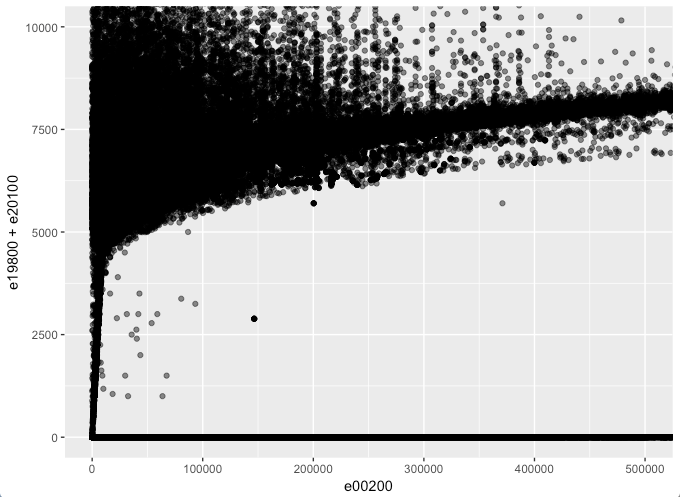

odd distribution of charitable deductions in CPS data

Originally opened in Tax-Calculator, re-opening here.

Looking at the cps.csv data, there are very few taxpayers with an income (e00200) over $10k that took a charitable deduction (e19800 + e20100) of more than zero dollars but less than $4,000 or so.

This doesn't seem like a particularly rare tax situation, where a moderate charitable deduction in combination with other deductions makes it worthwhile to itemize.

I don't have access to the PUF dataset, but @codykallen was kind enough to run some numbers. For each income group and dataset, the figures below represent the share of itemizers with a charitable deduction > $0 whose total charitable deduction was less than $4,000.

AGI > 10000 CPS: 0.15% PUF: 68.83%

AGI > 20000 CPS: 0.13% PUF: 68.50%

AGI > 50000 CPS: 0.11% PUF: 66.98%

AGI > 100000 CPS: 0.10% PUF: 63.44%

This is a pretty dramatic difference. Is there something I'm missing about the methodology behind the CPS file that could lead to this gap?

@reubenfb, I can't think of anything in the methodology that would result in the gap you've pointed out. I'll do some research to see if I can find a possible explanation and post any results I have here.